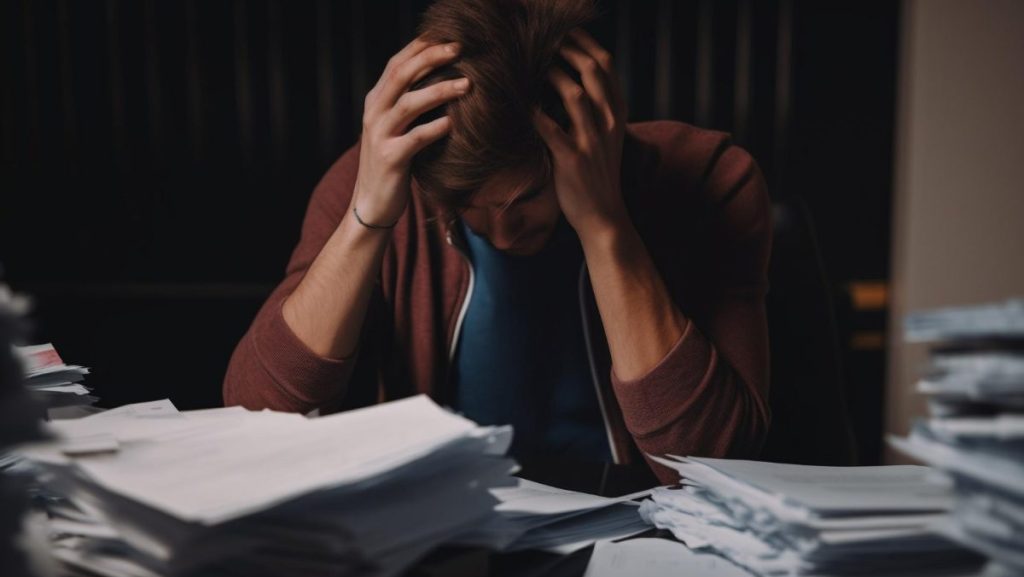

College Loan Forgiveness

Biden-Harris Administration to provide 804,000 borrowers with $39 billion in Automatic Loan Forgiveness as a result of fixes to Income Driven Repayment Plans.

Discharges are the result of updated counts of progress toward student loan forgiveness.

The Department of Education (Department) today will begin notifying more than 804,000 borrowers that they have a total of $39 billion in Federal student loans that will be automatically discharged in the coming weeks. In total, the Biden-Harris Administration has approved more than $116.6 billion in student loan forgiveness for more than 3.4 million borrowers.

The forthcoming discharges are a result of fixes implemented by the Biden-Harris Administration to ensure all borrowers have an accurate count of the number of monthly payments that qualify toward forgiveness under income-driven repayment (IDR) plans. These fixes are part of the Department’s commitment to address historical failures in the administration of the Federal student loan program in which qualifying payments made under IDR plans that should have moved borrowers closer to forgiveness were not accounted for. Borrowers are eligible for forgiveness if they have accumulated the equivalent of either 20 or 25 years of qualifying months.

“For far too long, borrowers fell through the cracks of a broken system that failed to keep accurate track of their progress towards forgiveness,” said U.S. Secretary of Education Miguel Cardona. “Today, the Biden-Harris Administration is taking another historic step to right these wrongs and announcing $39 billion in debt relief for another 804,000 borrowers. By fixing past administrative failures, we are ensuring everyone gets the forgiveness they deserve, just as we have done for public servants, students who were cheated by their colleges, and borrowers with permanent disabilities, including veterans. This Administration will not stop fighting to level the playing field in higher education.”

Today’s action is part of the Biden-Harris Administration’s implementation of the payment count adjustment announced in April 2022. That action addressed historical inaccuracies in the count of payments that qualify toward forgiveness under IDR plans. Under the Higher Education Act and the Department’s regulations, a borrower is eligible for forgiveness after making 240 or 300 monthly payments—the equivalent of 20 or 25 years on an IDR plan or the standard repayment plan, with the number of required payments varying based upon when a borrower first took out the loans, the type of loans they borrowed, and the IDR payment plan in which the borrower is enrolled. Inaccurate payment counts have resulted in borrowers losing hard-earned progress toward loan forgiveness. This action also addresses concerns about practices by loan servicers that put borrowers into forbearance in violation of Department rules. The Department previously began discharging loans for borrowers who reached forgiveness for Public Service Loan Forgiveness (PSLF) through these changes.

“At the start of this Administration, millions of borrowers had earned loan forgiveness but never received it. That’s unacceptable,” said Under Secretary James Kvaal. “Today we are holding up the bargain we offered borrowers who have completed decades of repayment.”

Borrowers receiving notifications in the coming days include those with Direct Loans or Federal Family Education Loans held by the Department (including Parent PLUS loans of either type) who have reached the necessary forgiveness threshold as a result of receiving credit toward IDR forgiveness for any of the following periods:

Any month in which a borrower was in a repayment status, regardless of whether payments were partial or late, the type of loan, or the repayment plan;

Any period in which a borrower spent 12 or more consecutive months in forbearance;

Any month in forbearance for borrowers who spent 36 or more cumulative months in forbearance;

Any month spent in deferment (except for in-school deferment) prior to 2013; and

Any month spent in economic hardship or military deferments on or after January 1, 2013.

In addition, months described above that occurred prior to a loan consolidation will also be counted toward forgiveness.

The Department will continue to identify and notify borrowers who reach the applicable forgiveness thresholds (240 or 300 qualifying monthly payments, depending on their repayment plan and type of loan) every two months until next year when all borrowers who are not yet eligible for forgiveness will have their payment counts updated. Any month counted for this purpose can also be counted toward PSLF if the borrower documents qualifying employment for that same period.

Eligible borrowers will be informed by the Department starting today that they qualify for forgiveness without further action on their part. Discharges will begin 30 days after emails are sent. Borrowers who wish to opt out of the discharge for any reason should contact their loan servicer during this period. Borrowers will be notified by their servicer after their debt is discharged. Those receiving forgiveness will have repayment on their loans paused until their discharge is processed, while those who opt out of the discharge will return to repayment once payments resume.

This action builds on the Biden-Harris Administration’s unparalleled record of student debt relief to date, including:

$45 billion for 653,800 public servants through improvements to PSLF;

$5 billion for 491,000 borrowers who have a total and permanent disability; and

$22 billion for nearly 1.3 million borrowers who were cheated by their schools, saw their schools precipitously close, or are covered by related court settlements.

President Biden and the Department have also taken steps to help borrowers access affordable payments going forward. The Department recently issued final regulations creating the most affordable payment plan ever—the Saving on a Valuable Education (SAVE) plan. The SAVE plan will cut payments on undergraduate loans in half compared to other IDR plans, ensure that borrowers never see their balance grow as long as they keep up with their required payments, and protect more of a borrower’s income for basic needs. A single borrower who makes less than $15 an hour will not have to make any payments. Borrowers earning above that amount will save more than $1,000 a year on their payments compared to other IDR plans. Benefits from the SAVE plan will start becoming available this summer.

This action builds on the Biden-Harris Administration’s unparalleled record of student debt relief to date, including:

$45 billion for 653,800 public servants through improvements to PSLF.

$5 billion for 491,000 borrowers who have a total and permanent disability.

$22 billion for nearly 1.3 million borrowers who were cheated by their schools, saw their schools precipitously close, or are covered by related court settlements.