Why I Appreci-Hate Credit Cards

By Mary Hunt

Erma Bombeck, the late humorist, summed up family relationships when she spoke of “the ties that bind… and gag!” That just makes me laugh because it is such a colorful word picture. Maybe you’ve thought this from time to time: “Family – can’t live with ’em, and can’t live without ’em!”

The same thing could be said about credit cards in these very strange times in which we live. Many people can’t live with them but can’t live without them, either.

Who could have foreseen a time when the very thing that has the ability to ruin so many lives (I do know a thing or two about that) would be the very thing that we require in this digital age?

The relationship I have with my credit card is appreciation on the one extreme and hatred on the other. I have an “appreci-hate” relationship with it. Yes, I said hate. It is a strong word.

My intention is that by the time you finish reading this, you, too, will appreci-hate credit cards with an intensity that propels you on the fast track to financial freedom.

The credit card relationship is a funny thing. When you maintain a $0 balance at the end of every month so that you have no credit card debt, you have a very useful financial tool that you are free to appreciate. Your $0 balance credit card works hard to keep your credit score high. That financial tool makes it possible for you to purchase an airline ticket, rent a car, buy things you need online – all without paying a nickel’s worth of interest. You get a 25-day grace period when you keep your balance at $0. You own it. You’re the boss of it. It works for you, and you win!

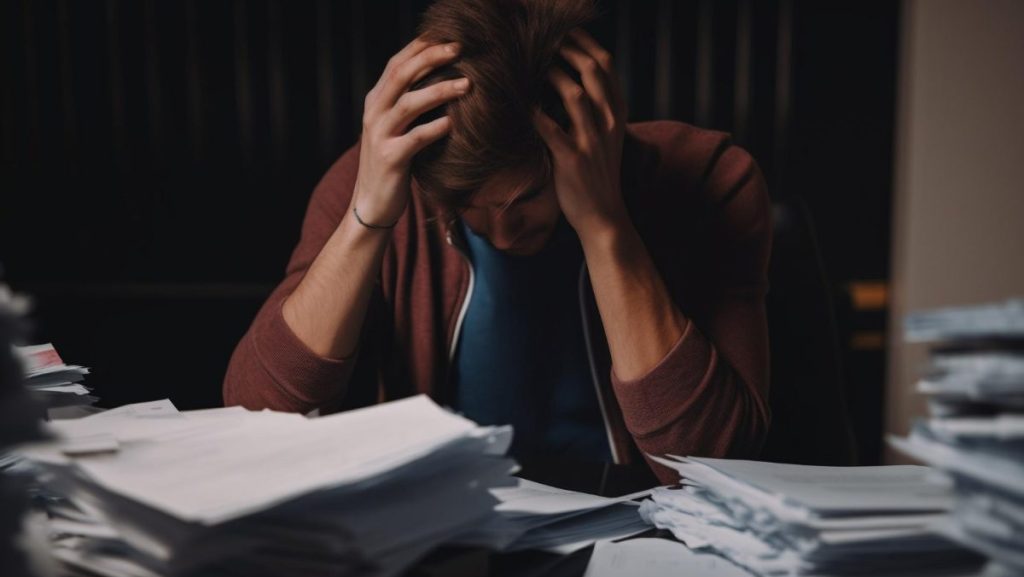

But if it’s the other way around, and you’ve racked up revolving debt that rolls from month to month accruing more and more interest, sorry, my friend. That credit card owns you. You are its slave. Yes, another strong word. So be it. That’s exactly the relationship.

That credit card debt beats you up to keep you down. It is a master of torture, inflicting cruel treatment.

Sure, I know it’s not that piece of plastic that’s to blame. You are responsible for your actions. But a lot of the blame must be on the banks and the credit card issuers who impose incredible terms and conditions – terms that can change midstream and interest rates that go to 29% and beyond. When your credit card owns you, the ties are wicked. They are ties that bind and strangle.

With interest rates in the double-digits and often nearing 30%, piled on by late fees, over-limit fees, variable interest rates, ridiculously low minimum monthly payments and open-ended credit structure (meaning if you pay down what you owe, you can borrow back up to your credit limit any time) – credit card debt is designed to imprison unsuspecting, naive, needy people who only wanted it in the first place to use in case of emergency.

There’s only one way to break the stranglehold of credit card debt, and that is to pay back every last dime of that revolving debt balance. Before you cut me off, let me say that I know from personal experience that won’t be easy, but it’s doable.

If you could use some help with getting started, then staying on track right down to owing $0, check out a book I wrote about my own journey, experience, and debt-free outcome! Through the pages, I will walk with you step by step, guiding and encouraging you. “Debt-Proof Living” (by me!) is available wherever books are sold.