Pay Down or Pay Ahead. It can be confusing

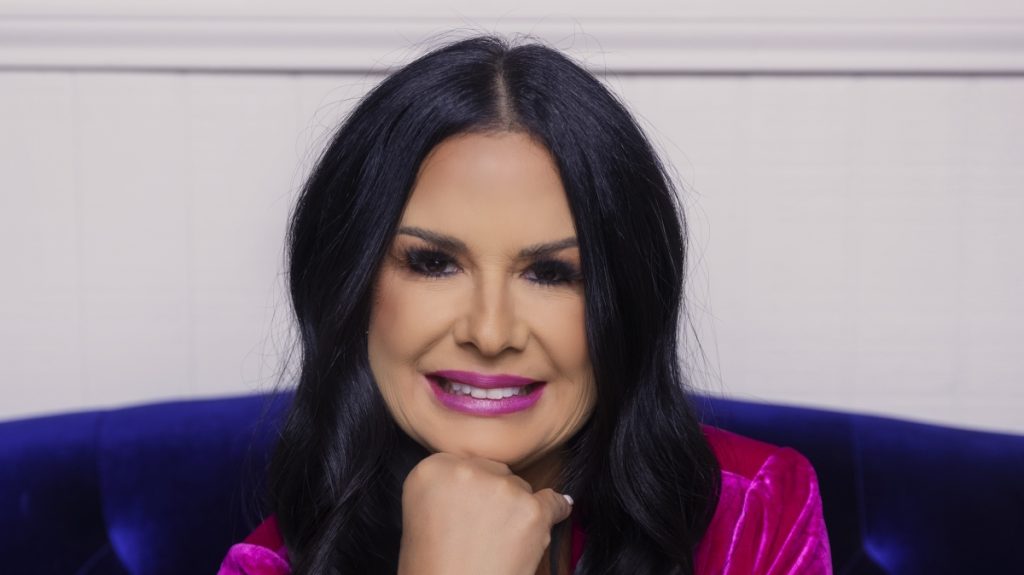

By Mary Hunt

Years ago, I learned a lesson I won’t have to learn again. It was that poignant. It was during a time when mortgage interest rates took a nosedive, and we benefited by refinancing our high-rate mortgage.

The transaction closed in late August with the first payment due in October. Rather than take a month off from making a mortgage payment, we made an unscheduled payment in September to reduce the principal balance right off the bat. We sent a letter with the payment and wrote “Principal Prepayment” on the check.

A few weeks later, we got a statement showing that the payment had been credited to the October payment, not to pay down the principal as instructed. The confused customer service rep was kind but hardly apologetic when she explained that someone must have assumed that we really wanted to “pay ahead” rather than “pay down.” It took a little persistence to convince her of the contrary.

Applying that unscheduled payment to the principal balance was good for us because every penny went to reduce the balance. No interest was due until October. That was profitable for us but not for the lender.

By reducing the principal at the beginning of the loan, we would go on to save more than $4,000 in interest and cut three months off the term, which we did. And, oh, what a happy day that was!

On the other hand, applying it to the October payment would have put almost the entire amount into the lender’s pocket in the form of interest.

This doesn’t mean that it is never wise to pay ahead on a mortgage or some other kind of debt. Here’s a quick overview:

Pay Down The Principal

When you pay down the principal, your loan balance goes down. But you must still make the next scheduled payment. Let’s say you make your regular mortgage payment in April plus three extra payments. Your plan is to pay off your mortgage ahead of schedule so you can avoid paying a load of interest. You enclose a note that the additional payments are to pay down the principal balance. You will still have payment due in May and June and July, as scheduled.

Pay The Payments Ahead

Now let’s say that the reason you are sending those three extra payments is because you are going to Europe for the summer and want to pay your bills in advance before you leave. In this scenario, you want to pay ahead. You’ll be back before the August payment is due.

If you are not very clear how you want the extra funds handled, the lender might assume you want to pay down the principal balance. Say you head off on your trip assuming you’ve made your mortgage payments for the time you’ll be out of the country. You arrive home only to learn that your home is in foreclosure for failure to pay.

Some lenders will simply return additional payments if it is not clear how they are to be handled. Others automatically apply additional sums to future payments, defaulting to the lender’s benefit.

Overexplain. Then Follow Up

When you make prepayments on your financial obligation, always enclose clear instructions. And make sure you abbreviate your instructions on the check or payment advice itself. But don’t leave it there. Follow up in a couple of weeks to make sure the transaction was handled per your instructions. And don’t be surprised if your lender is not easily persuaded to pay down. Or if it fails to pay ahead. Don’t give up.

And, by the way, unless you have a prepayment penalty clause in your terms and conditions, you have every legal right to pay down your mortgage, student loans or credit card balance provided you are not in default.