Dangerous Loans

Longview high school students learn to spot dangerous loans, how to make money work for them instead of working for money.

By Joycelyne Fadojutimi

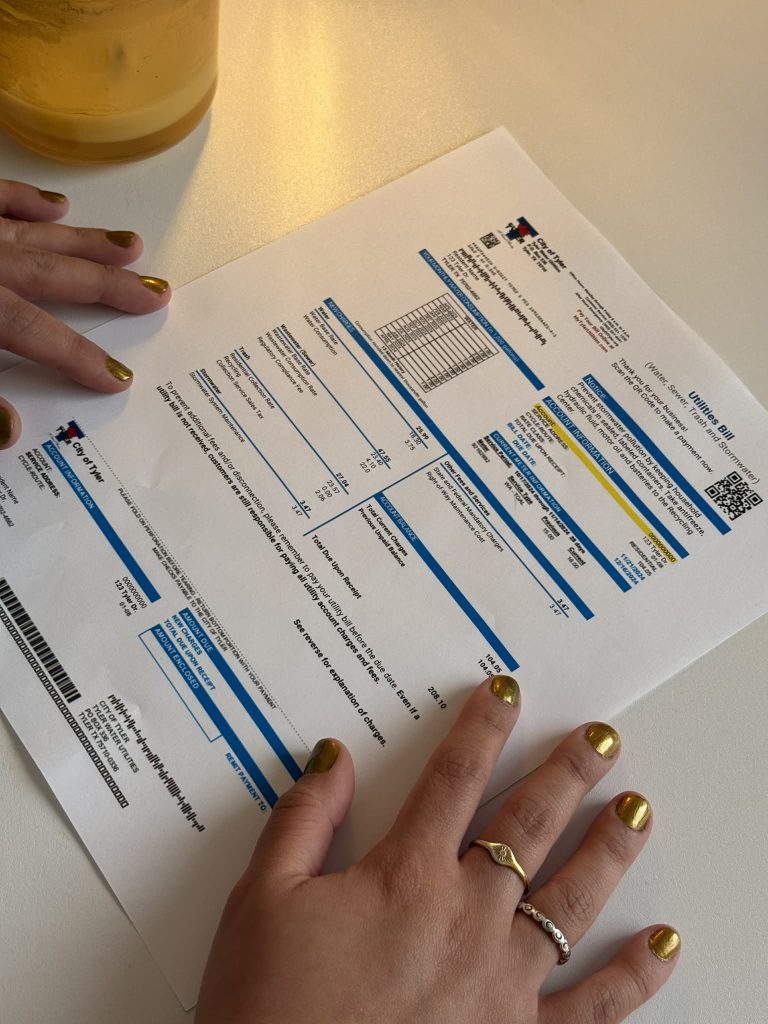

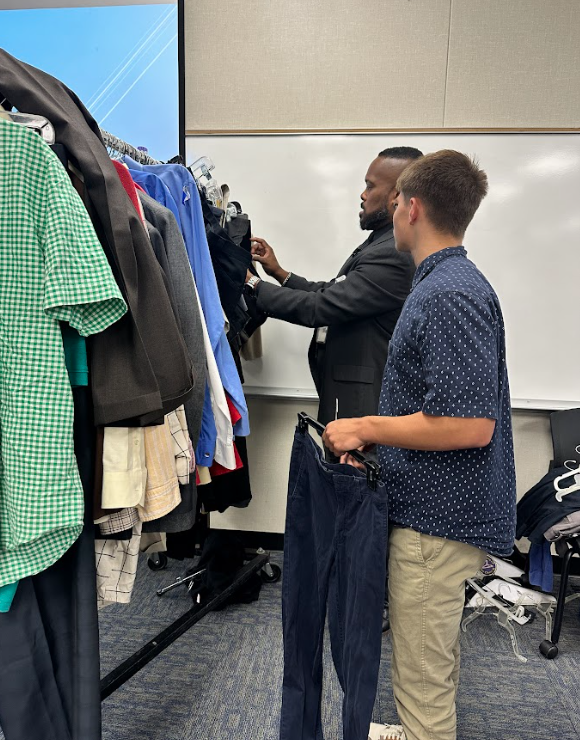

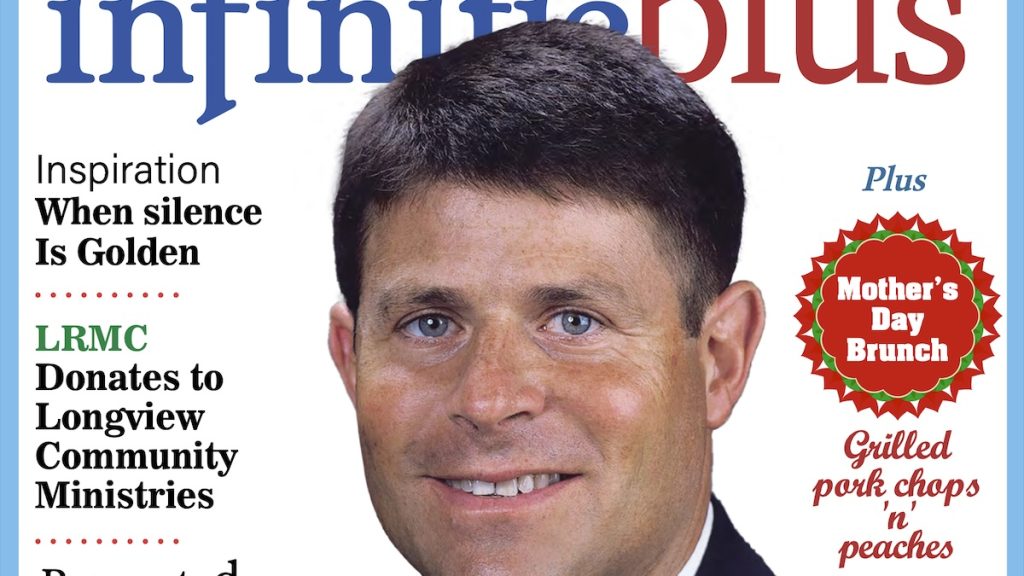

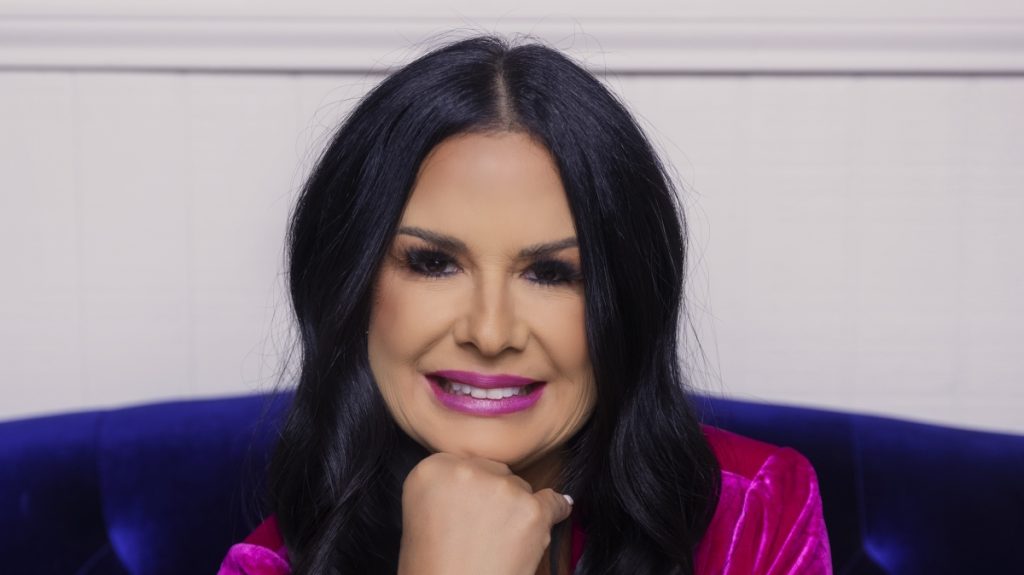

Roberto Monsivais Community Development Mortgage Loan Originator with Cadence Bank spoke to Longview high school students about dangerous loans and how to spot them. In fact, that was the title of his lecture…Dangerous Loans.

“I wanted the kids to be more aware of loans that benefit customers versus the lender. With the uncertainty of where they’ll be after high school, reaching out to trusted adults and relationships for advice and feedback is a powerful tool.”

Roberto Monsivais, Cadence Bank Community Development Mortgage Loan Originator

Having such trustworthy advisors at one’s elbow during the loan process, reviewing and extrapolating on the documentation is a priceless asset. Monsivais recounted personal experiences that impressed on his listeners the degree of damage that can be inflicted by an unscrupulous lender. The responsibilities created by the need for money can result in one deviating from pre-set goals and agreeing to something not fully understood and that benefits someone other than the borrower.

He stressed the crucial nature of his listeners learning such procedures before they start out on a big purchase like a homeowner’s loan, car loan or even furniture stores gimmicks like no interest for sixty months. He also recommended creating good credit by starting out with a higher rate if needed and then saving money by refinancing within twelve to twenty-four months. Moreover, Monsivais warned his audience against payday loans.

“These rates are typically too high to pay them back. This typically causes bank account issues or negative reporting to credit bureaus,” he said. “You pay them back so quickly, and it never helps your credit. They keep you coming back over and over without really helping you for the long term.”

The bottom line to his message was emphasizing how important it is to understand everything one signs, so that loans are a safe, temporary, and useful tool.

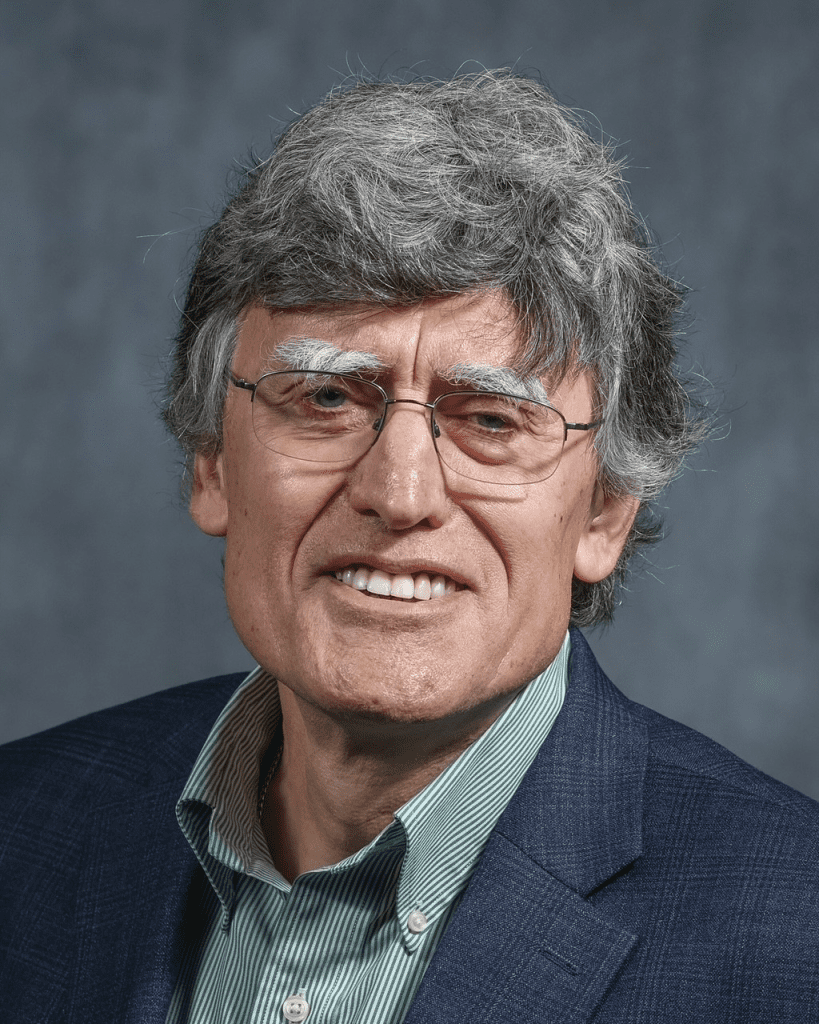

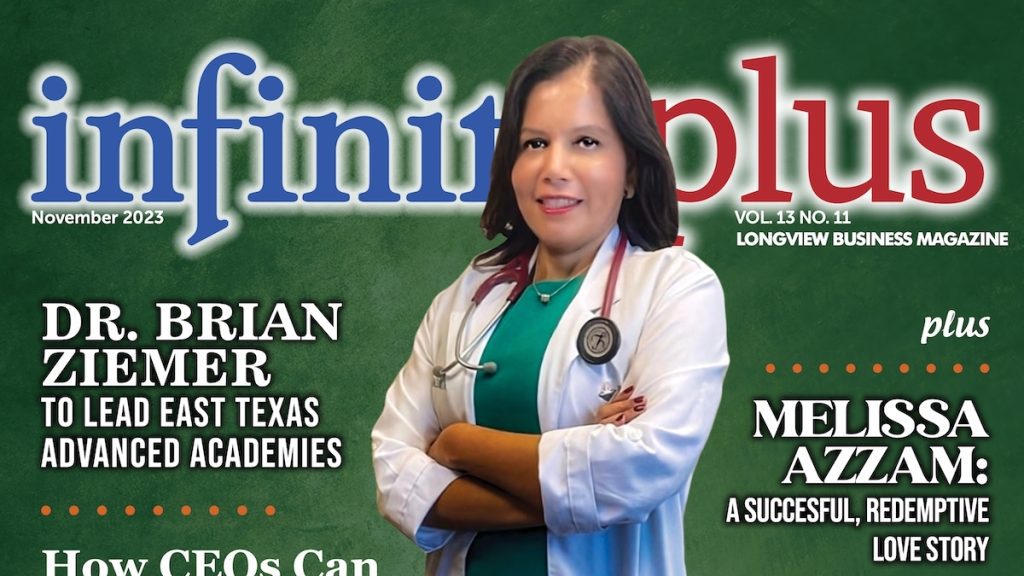

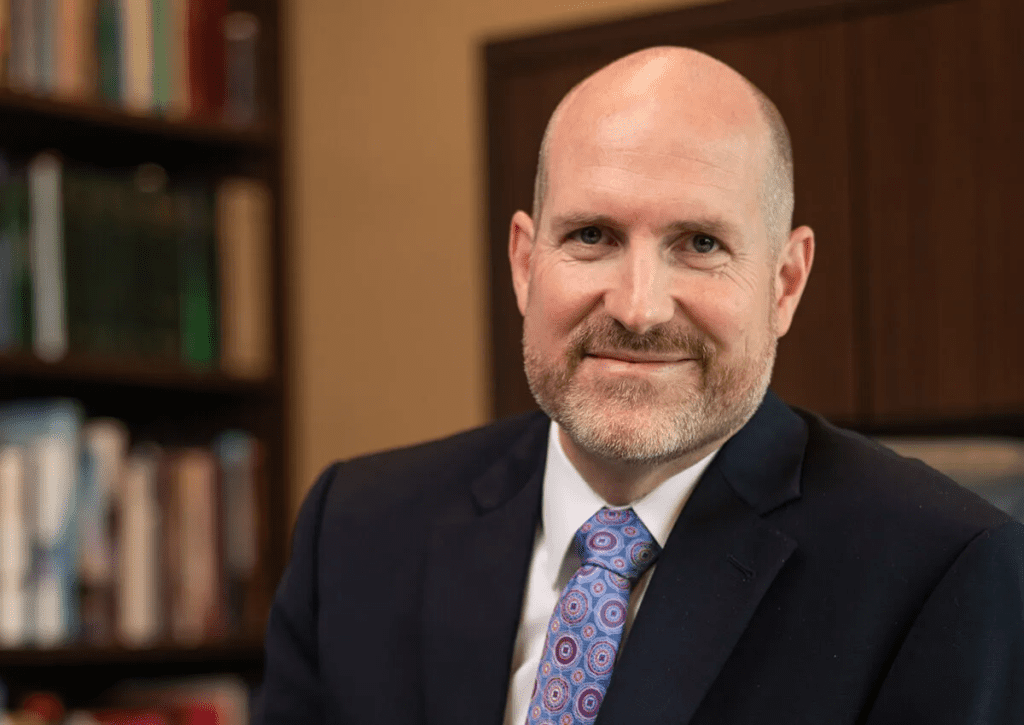

John Nustad, a loan officer with Guild Mortgage was the second speaker. He presented Longview High School students with some very promising words for the future. Nustad told them how working for money is not as promising as having it work for them. Discipline and spending wisely is key to consistent, dependable income. He stressed the significant differences between how the poor, rich and wealthy people spend their income.

“The poor spend money on stuff. The rich buy liabilities. The wealthy buy assets. Given the choice it is better to be wealthy over rich,” he says. “The problem with the rich approach is that you only make money as long as you work. The only thing of value that you have to sell is your time. You only have a finite amount of time and energy, so this is a losing proposition.”

John Nustad, Guild Mortgage Loan Officer.

Disciplined money management is the route to financially comfortable futures because becoming wealthy takes a lot of effort. It does not just happen, but when it is attained it brings economic stability and hence financial freedom. Those who lack financial freedom are essentially enslaved to their own moods, appetites and passions and live from insufficient paycheck to insufficient paycheck.

Nustad points to the ringing declaration of famed financier Dave Ramsey, who says, “You will either learn to manage money, or the lack of it will manage you.” The landscape of the financial world is dissimilar to school–You rarely have a literate teacher telling you what to do. This includes a certain lack of guidance attaining long-term goals.

Furthermore, Nustad instructed his youthful audience on how to decide on what their values are and how to position them. Definiteness of purpose is always the first step toward the goal of success.

“We can better handle discomfort when we associate it with a goal,” he says. “It’s not that you have to but get to. It ain’t giving up but giving for. When your values are clear, decision-making becomes easier.”

He challenged his listeners to, once they have identified and established their goals, to lay out and firmly stick to a budget. An emergency fund is necessary so that unanticipated developments does not derail your budget.

“Give and invest first, and then spend what is left over instead of spending, and then giving and investing from your excess. We have unlimited needs and wants, so if we don’t prioritize, well then it will not happen.”

According to Nustad, it is also a good idea to automate one’s investing. Removing oneself from the process increases consistency.

He stated, “Money flows like water. It takes the path of least resistance. You must tell every dollar where to go or you will wonder where it went.”

In conclusion, Nustad advised the young people to appreciate where they are, or they would never be appreciative of where they wind up. He recommended they read the following books in this order:

- Rich Dad Poor Dad by Robert Kiyosaki, Pinnacle Publishing.

- Richest Man in Babylon by George S. Clason, Principles Publishing.

- Total Money Makeover by Dave Ramsey, Foundation Publishing.

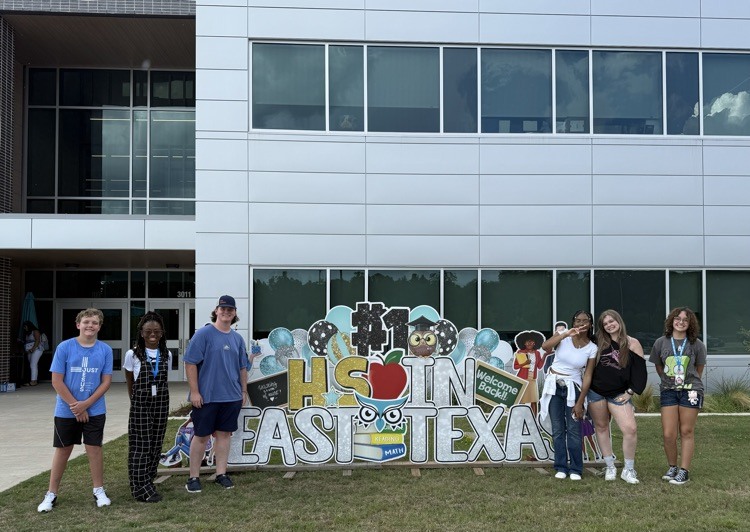

LOBO TALKS is patterned after the worldwide motivation, and education program “TED TALKS” where various experts visit college campuses and theatres to educate their audience. Longview ISD Community Relations Department created LOBO TALKS with a similar format. Once a month, they invite community experts to Longview High School who speak to at-risk and business students. LOBO TALKS was launched in October 2022.